Oklahoma Bankruptcy HelpThe Fate of Unpaid Utility Bills in Bankruptcy: A Comprehensive Guide

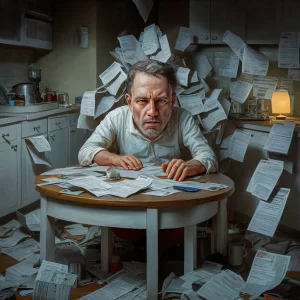

Many everyday people end up finding themselves in dire financial circumstances for one reason or another. Despite your best efforts to catch up on your bills and pay off your debts you may find that it is almost impossible to do so.

Many everyday people end up finding themselves in dire financial circumstances for one reason or another. Despite your best efforts to catch up on your bills and pay off your debts you may find that it is almost impossible to do so.

This can be a serious issue when your debts include unpaid utility bills. Once the utility company decides to turn off your service it can be quite disruptive to your life, adding yet another hurdle for you to overcome in an already challenging fight to dig yourself out of a financial hole. This is where filing for bankrtupcy may be a good idea.

The bankruptcy process is a legal mechanism that allows debtors to discharge or reorganize debt in order for you to start over with a clean financial slate. Part of the debt being discharged or reorganized may be unpaid utility bills. How utility bills are dealt with in bankrtupcy will depend on whether you choose a Chapter 7 or a Chapter 13 bankruptcy.

Different Types of Bankruptcy: Chapter 7 and Chapter 13

Bankruptcy law offers several types of bankruptcy, but Chapter 7 and Chapter 13 are the most common for individuals:

- Chapter 7 Bankruptcy: This type of bankruptcy entails liquidation of all non-exempt assets in order to pay creditors. Also, most remaining unsecured debts are usually discharged. The Chapter 7 bankrtupcy process can usually take a few months to complete.

- Chapter 13 Bankruptcy: This type of bankruptcy will create a repayment plan and allows debtors to remain in possession of their property. A Chapter 13 repayment plan is usually designed to last from three to five years.

Dealing with Unpaid Utility Bills in Bankruptcy

Unpaid utility bills are considered unsecured debts, similar to credit card debt or medical bills. In bankruptcy, these debts can be discharged, meaning the debtor is no longer legally required to pay them. However, it’s important to note that utility companies may require a deposit to continue providing services post-bankruptcy.

Utility Bills Under Chapter 7 Bankruptcy

In Chapter 7 bankruptcy, unpaid utility bills up to the filing date are typically discharged. However, utility companies may request a security deposit for continued service. A Tulsa bankruptcy attorney can negotiate the amount of this deposit and ensure that services are not interrupted.

Utility Bills Under Chapter 13 Bankruptcy

Chapter 13 bankruptcy allows debtors to reorganize their debts, including unpaid utility bills in order to create a repayment plan lasting three to five years. This type of bankruptcy is suitable for individuals with a steady income who want to keep their property and repay their debts over time.

In Chapter 13 bankruptcy, unpaid utility bills are included in the repayment plan. The debtor continues to make regular payments towards these bills as part of the overall plan. It is possible a portion of the utility bill debt is dismissed as a part of the repayment plan, depending on how negotiations with the utility company turns out.

A Tulsa bankruptcy lawyer ensures that the plan is realistic and that the debtor can maintain essential utility services. Debtline Law Office attorneys have the experience necessary to deal with utility companies in order for you to obtain the best deal possible.

What Happens After Bankruptcy?

Life after bankruptcy involves rebuilding financial health and re-establishing creditworthiness. It can be a challenging process, but it’s also an opportunity for a fresh start. Debtors need to create and adhere to a budget, avoid accumulating new debts, and take steps to improve their credit scores.

Therefore, it is important to take long-term perspective when filing for bankruptcy. Although it may be challenging at first with all of the paperwork, filing deadlines, and court dates, bankruptcy can be the first step in rehabilitating your personal finances. Also, a Tulsa bankruptcy attorney can be a tremendous help in navigating through the process.

How a Tulsa Bankruptcy Attorney Can Assist in Rebuilding Financial Health

An Oklahoma bankruptcy attorney can provide post-bankruptcy advice and resources to help clients rebuild their financial health. This includes guidance on budgeting, credit repair, and avoiding future financial pitfalls. Their ongoing support is crucial for clients to achieve long-term financial stability.

Bankruptcy provides a legal means to manage and discharge debts, including unpaid utility bills. Chapter 7 and Chapter 13 bankruptcy offer different approaches, and an experienced Oklahoma bankruptcy attorney can provide essential guidance throughout the process.

The complexities of bankruptcy law make it imperative to seek advice from a seasoned Tulsa bankruptcy attorney. Their expertise ensures that clients make informed decisions, protect their rights, and achieve the best possible outcome.

Hire a Debtline Law Office Tulsa Bankruptcy Attorney

Having a professional Tulsa bankruptcy attorney by your side is invaluable. Debtline Law Office provides the knowledge, support, and representation needed to successfully navigate bankruptcy and rebuild your financial health. Also, our Tulsa bankruptcy attorneys have extensive experience in negotiating with creditors, ensuring that you will achieve the best deal possible.

Don’t hesitate to seek the help you need for a brighter financial future. Contact Debtline Law Office by calling (918) 786-9600 and schedule your free debt relief consultation today. The sooner you call us, the faster you will be able to start your journey towards regaining your financial freedom and moving past your current fiscal challenges.